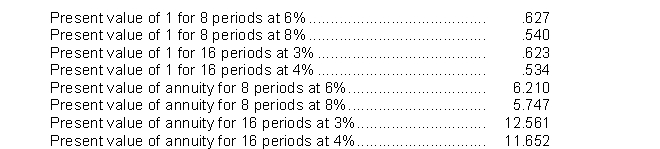

Use the following information for questions.issued eight-year bonds with a face value of $1,000,000 and a stated interest rate of 6%, payable semiannually on June 30 and December 31.The bonds were sold to yield 8%.Table values are:

-Feller Company issues $20,000,000 of 10-year, 9% bonds on March 1, 2010 at 97 plus accrued interest.The bonds are dated January 1, 2010, and pay interest on June 30 and December 31.What is the total cash received on the issue date?

A) $19,400,000

B) $20,450,000

C) $19,700,000

D) $19,100,000

Correct Answer:

Verified

Q45: Bond issuance costs, including the printing costs

Q50: Note disclosures for long-term debt generally include

Q51: In a debt extinguishment in which the

Q52: When a note payable is exchanged for

Q53: The debt to total assets ratio is

Q55: When a note payable is issued for

Q57: Use the following information for questions.issued eight-year

Q57: The printing costs and legal fees associated

Q58: The amortization of a premium on bonds

Q64: All of the following are differences between

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents