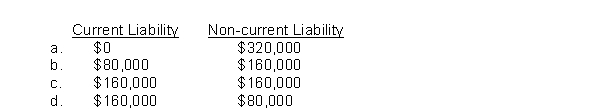

On January 1, 2010, Beyer Co.leased a building to Heins Corp.for a ten-year term at an annual rental of $80,000.At inception of the lease, Beyer received $320,000 covering the first two years' rent of $160,000 and a security deposit of $160,000.This deposit will not be returned to Heins upon expiration of the lease but will be applied to payment of rent for the last two years of the lease.What portion of the $320,000 should be shown as a current and non-current liability, respectively, in Beyer's December 31, 2010 statement of financial position?

Correct Answer:

Verified

Q119: Blitz Corporation, a manufacturer of cleaning products,

Q120: LeMay Frosted Flakes Company offers its customers

Q121: Neer Co.has a probable loss that can

Q122: During 2010, Eaton Co.introduced a new product

Q123: Yount Trading Stamp Co.records stamp service revenue

Q124: On September 1, 2010, Herman Co.issued a

Q125: Included in Vernon Corp.'s liability account balances

Q126: Felton Co.sells major household appliance service contracts

Q127: On January 3, 2010, Boyer Corp.owned a

Q129: Edge Company's salaried employees are paid biweekly.Occasionally,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents