Use the following information for questions.

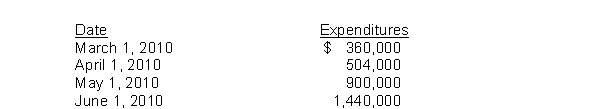

On March 1, 2010, Newton Company purchased land for an office site by paying $540,000 cash.Newton began construction on the office building on March 1.The following expenditures were incurred for construction:

The office was completed and ready for occupancy on July 1.To help pay for construction, $720,000 was borrowed on March 1, 2010 on a 9%, 3-year note payable.Other than the construction note, the only debt outstanding during 2010 was a $300,000, 12%, 6-year note payable dated January 1, 2010.

-During 2010, Bass Corporation constructed assets costing $1,000,000.The weighted-average accumulated expenditures on these assets during 2010 was $600,000.To help pay for construction, $440,000 was borrowed at 10% on January 1, 2010, and funds not needed for construction were temporarily invested in short-term securities, yielding $9,000 in interest revenue.Other than the construction funds borrowed, the only other debt outstanding during the year was a $500,000, 10-year, 9% note payable dated January 1, 2004.What is the amount of interest that should be capitalized by Bass during 2010?

A) $60,000.

B) $30,000.

C) $58,400.

D) $94,400.

Correct Answer:

Verified

Q60: Interest revenue earned on specific borrowings for

Q61: Huffman Corporation constructed a building at a

Q62: Mendenhall Corporation constructed a building at a

Q63: During self-construction of an asset by Richardson

Q64: Use the following information for questions.

On March

Q66: Use the following information for questions.

La Bianco

Q67: Use the following information for questions.

On January

Q68: During 2010, Kimmel Co.incurred average accumulated expenditures

Q69: During self-construction of an asset by Samuelson

Q70: Messersmith Company is constructing a building.Construction began

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents