Use the following information to answer questions

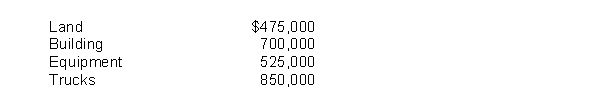

Jamison Company purchased the assets of Booker Company at an auction for $1,400,000.An independent appraisal of the fair value of the assets is listed below:

-On December 1, Miser Corporation exchanged 2,000 shares of its $25 par value ordinary shares held in treasury for a parcel of land to be held for a future plant site.The treasury shares were acquired by Miser at a cost of $40 per share, and on the exchange date the ordinary shares of Miser had a fair value of $50 per share.Miser received $6,000 for selling scrap when an existing building on the property was removed from the site.Based on these facts, the land should be capitalized at

A) $74,000.

B) $80,000.

C) $94,000.

D) $100,000.

Correct Answer:

Verified

Q112: Use the following information to answer questions

Q113: Hardin Company received $40,000 in cash and

Q114: Use the following information to answer questions

Q115: On January 2, 2010, Rapid Delivery Company

Q116: Use the following information to answer questions

Q118: Use the following information for questions.

Glen Inc.and

Q119: Use the following information to answer questions

Q120: Use the following information to answer questions

Q121: Durler Company traded machinery with a book

Q122: Timmons Company traded machinery with a book

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents