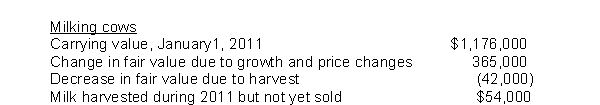

Dub Dairy produces milk to sell to local and national ice cream producers.Dub Dairy began operations on January 1, 2011 by purchasing 840 milk cows for $1,176,000.The company controller had the following information available at year end relating to the cows:  On Dub Dairy's income statement for the year ending December 31, 2011, what amount of unrealized gain on harvested milk will be reported?

On Dub Dairy's income statement for the year ending December 31, 2011, what amount of unrealized gain on harvested milk will be reported?

A) No gain is reported until the milk is sold.

B) $12,000

C) $54,000

D) $311,000

Correct Answer:

Verified

Q70: Lucy's Llamas purchased 1,000 llamas on January

Q71: Given the historical cost of product Z

Q72: Confectioners, a chain of candy stores, purchases

Q73: Rios, Inc.uses International Financial Reporting Standards (IFRS).In

Q74: Braum Dairy produces milk to sell to

Q76: Lenny's Llamas purchased 1,500 llamas on January

Q77: Given the historical cost of product Z

Q78: Robust Inc.has the following information related to

Q79: Dub Dairy produces milk to sell to

Q80: Dub Dairy produces milk to sell to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents