Use the following information for questions.

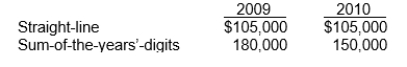

Ventura Corporation purchased machinery on January 1, 2009 for $630,000.The company used the sum-of-the-years'-digits method and no salvage value to depreciate the asset for the first two years of its estimated six-year life.In 2010, Ventura changed to the straight-line depreciation method for this asset.The following facts pertain:

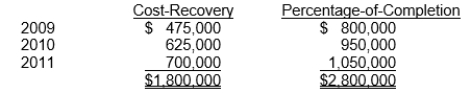

-During 2011, a construction company changed from the cost-recovery method to the percentage-of-completion method for accounting purposes but not for tax purposes.Gross profit figures under both methods for the past three years appear below:

Assuming an income tax rate of 40% for all years, the affect of this accounting change on prior periods should be reported by a credit of

A) $600,000 on the 2011 income statement.

B) $390,000 on the 2011 income statement.

C) $600,000 on the 2011 retained earnings statement.

D) $390,000 on the 2011 retained earnings statement.

Correct Answer:

Verified

Q9: An example of a correction of an

Q41: Which of the following statements is correct?

A)Changes

Q50: Sun construction company decided at the beginning

Q51: Use the following information for questions.

Ventura Corporation

Q53: Jacob, Inc., changed from the average cost

Q54: Lanier Company began operations on January 1,

Q56: Detmer Constuction Company decided at the beginning

Q58: Use the following information for questions.

On January

Q59: On January 1, 2009, Piper Co., purchased

Q60: On January 1, 2009, Neal Corporation acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents