Use the following information for questions.

Yueve's Company is negotiating three leases for store locations Yueve's incremental borrowing rate is 12 percent and the lessor's implicit rate is unkown (it is impracticable to determine)

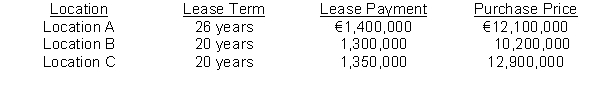

Each store will have an economic useful life of 30 years.lease payments will be made at the end of each year.Based on the data below properly classify each of the leases as an operating lease or a finance lease.The purchase price for each property is listed as an alternative to leasing.

-Based on this information, which test(s) does Location A pass for classifying the lease as a finance lease.

Correct Answer:

Verified

Q48: All of the following statements are true

Q49: For a sales-type lease,

A)the sales price includes

Q50: The Lease Liability account should be disclosed

Q51: If companies want to disqualify a lease

Q52: If the lease in a sale-leaseback transaction

Q54: In a sale-leaseback transaction where none of

Q54: When a company sells property and then

Q56: To avoid leased asset capitalization, companies can

Q57: Which of the following statements is correct?

A)In

Q58: When lessors account for residual values related

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents