Use the following information for questions.

Yueve's Company is negotiating three leases for store locations Yueve's incremental borrowing rate is 12 percent and the lessor's implicit rate is unkown (it is impracticable to determine)

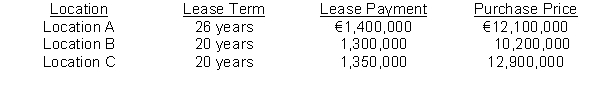

Each store will have an economic useful life of 30 years.lease payments will be made at the end of each year.Based on the data below properly classify each of the leases as an operating lease or a finance lease.The purchase price for each property is listed as an alternative to leasing.

-Based on this information, which test(s) does Location B pass for classifying the lease as a finance lease.

Correct Answer:

Verified

Q23: The IASB requires lessees and lessors to

Q27: Which of the following would not be

Q39: Executory costs include

A)maintenance.

B)property taxes.

C)insurance.

D)all of these.

Q41: On December 1, 2011, Goetz Corporation leased

Q42: All of the followings are ways in

Q45: All of the following statements are true

Q46: Which of the following is true regarding

Q47: On January 1, 2011, Dean Corporation signed

Q48: All of the following statements are true

Q49: For a sales-type lease,

A)the sales price includes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents