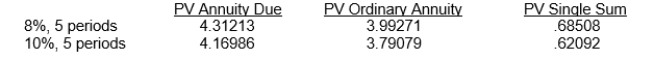

Haystack, Inc.manufactures machinery used in the mining industry.On January 2, 2011 it leased equipment with a cost of $200,000 to Silver Point Co.The 5-year lease calls for a 10% down payment and equal annual payments at the end of each year.The equipment has an expected useful life of 5 years.Silver Point's incremental borrowing rate is 10%, and it depreciates similar equipment using the double-declining balance method.The selling price of the equipment is $325,000, and the rate implicit in the lease is 8%, which is known to Silver Point Co.What is the amount of interest expense recorded by Silver Point Co.for the year ended December 31, 2011?

A) $29,250

B) $23,400

C) $26,000

D) $32,500

Correct Answer:

Verified

Q50: Which of the following is true regarding

Q58: When lessors account for residual values related

Q60: Use the following information for questions.

Yueve's Company

Q61: Use the following information for questions.

On January

Q62: Pisa, Inc.leased equipment from Tower Company under

Q64: Use the following information for questions.

On January

Q65: Use the following information for questions.

On January

Q66: On December 31, 2011, Lang Corporation leased

Q67: Use the following information for questions.

On January

Q69: Use the following information for questions

On

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents