Use the following information for questions.

Alt Corporation enters into an agreement with Yates Rentals Co.on January 1, 2011 for the purpose of leasing a machine to be used in its manufacturing operations.The following data pertain to the agreement:

(a) The term of the noncancelable lease is 3 years with no renewal option.Payments of $155,213 are due on December 31 of each year.

(b) The fair value of the machine on January 1, 2011, is $400,000.The machine has a remaining economic life of 10 years, with no residual value.The machine reverts to the lessor upon the termination of the lease.

(c) Alt depreciates all machinery it owns on a straight-line basis.

(d) Alt's incremental borrowing rate is 10% per year.Alt does not have knowledge of the 8% implicit rate used by Yates.

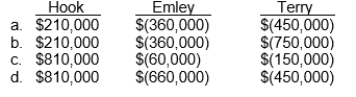

-Hook Company leased equipment to Emley Company on July 1, 2010, for a one-year period expiring June 30, 2011, for $60,000 a month.On July 1, 2011, Hook leased this piece of equipment to Terry Company for a three-year period expiring June 30, 2014, for $75,000 a month.The original cost of the equipment was $4,800,000.The equipment, which has been continually on lease since July 1, 2006, is being depreciated on a straight-line basis over an eight-year period with no residual value.Assuming that both the lease to Emley and the lease to Terry are appropriately recorded as operating leases for accounting purposes, what is the amount of income (expense) before income taxes that each would record as a result of the above facts for the year ended December 31, 2011?

Correct Answer:

Verified

Q60: Use the following information for questions 54

Q62: Emporia Corporation is a lessee with a

Q78: Use the following information for questions

Alt

Q81: On January 2, 2011, Gold Star Leasing

Q82: Use the following information for questions.

Hull Co.leased

Q86: Use the following information for questions.

Alt Corporation

Q87: Geary Co.leased a machine to Dains Co.Assume

Q88: Use the following information for questions.

Hull Co.leased

Q89: Haystack, Inc.manufactures machinery used in the mining

Q91: Mays Company has a machine with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents