Use the following information for questions.

At the beginning of 2012, Pitman Co.purchased an asset for $600,000 with an estimated useful life of 5 years and an estimated residual value of $50,000.For financial reporting purposes the asset is being depreciated using the straight-line method; for tax purposes the double-declining-balance method is being used.Pitman Co.'s tax rate is 40% for 2012 and all future years.

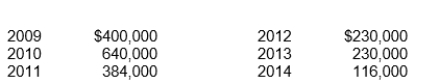

-Lehman Corporation purchased a machine on January 2, 2009, for $2,000,000.The machine has an estimated 5-year life with no residual value.The straight-line method of depreciation is being used for financial statement purposes and the following accelerated depreciation amounts will be deducted for tax purposes:

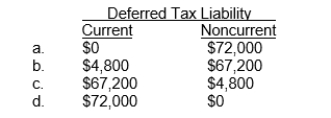

Assuming an income tax rate of 30% for all years, the net deferred tax liability that should be reflected on Lehman's statement of financial position at December 31, 2010, should be

Correct Answer:

Verified

Q29: An assumption inherent in a company's IFRS

Q37: A company uses the equity method to

Q40: Taxable income of a corporation

A)differs from accounting

Q41: Use the following information for questions.

Hopkins Co.at

Q43: Use the following information for questions.

Hopkins Co.at

Q44: Use the following information for questions.

Hopkins Co.at

Q45: Under IFRS deferred tax assets are recognized

Q46: Which of the following statements is incorrect

Q47: All of the following are procedures for

Q58: Deferred taxes should be presented on the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents