Use the following information for questions.

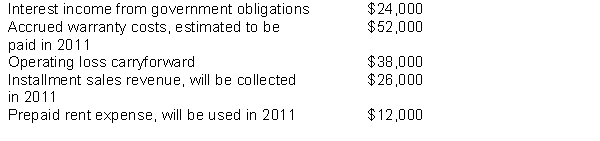

At the beginning of 2010; Elephant, Inc.had a deferred tax asset of $4,000 and a deferred tax liability of $6,000.Pre-tax accounting income for 2010 was $300,000 and the enacted tax rate is 40%.The following items are included in Elephant's pre-tax income:

-Which of the following is required to adjust Elephant, Inc.'s deferred tax asset to its correct balance at December 31, 2010?

A) A debit of $20,800

B) A credit of $15,200

C) A debit of $15,200

D) A debit of $16,800

Correct Answer:

Verified

Q70: Use the following information for questions.

Lyons Company

Q71: Larsen Corporation reported $100,000 in revenues in

Q72: Use the following information for questions.

Hopkins Co.at

Q73: Use the following information for questions.

Kraft Company

Q74: Use the following information for questions.

At the

Q76: Use the following information for questions.

At the

Q77: Use the following information for questions.

Kraft Company

Q78: Use the following information for questions.

Lyons Company

Q79: Use the following information for questions.

Mitchell Corporation

Q80: Use the following information for questions.

Kraft Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents