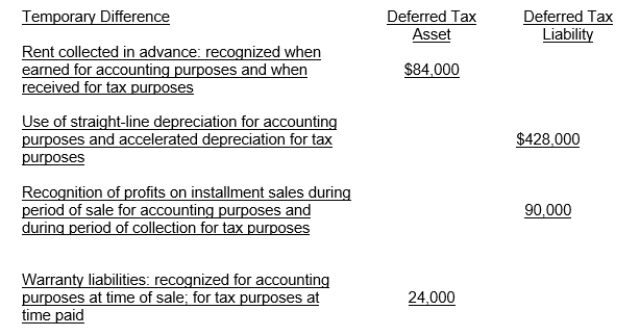

Lincoln Company has the following four deferred tax items at December 31, 2012.The deferred tax assets and the deferred tax liabilities relate to income taxes levied by the same tax authority.On Lincoln's December 31, 2012 statement of financial position, it will report

A) $108,000 current deferred tax asset.

B) $626,000 non-current deferred tax liability.

C) $410,000 non-current deferred tax liability.

D) $518,000 current tax payable.

Correct Answer:

Verified

Q82: Use the following information for questions.

Wilcox Corporation

Q83: Georgia, Inc.has no temporary or permanent differences.The

Q84: A reconciliation of Gentry Company's pretax accounting

Q85: Use the following information for questions.

Operating income

Q86: Use the following information for questions.

Operating income

Q87: Rodd Co.reports a taxable and pretax financial

Q89: At December 31, 2010 Raymond Corporation reported

Q90: Use the following information for questions.

Wilcox Corporation

Q91: Nickerson Corporation began operations in 2007.There have

Q92: Khan, Inc.reports a taxable and financial loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents