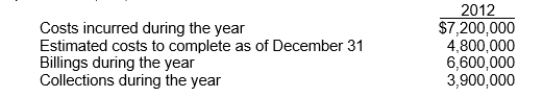

Monroe Construction Company uses the percentage-of-completion method of accounting.In 2012, Monroe began work on a contract it had received which provided for a contract price of $15,000,000.Other details follow:

What should be the gross profit recognized in 2012?

A) $600,000

B) $7,800,000

C) $1,800,000

D) $3,000,000

Correct Answer:

Verified

Q36: Which of the following are recognized each

Q37: Sales in which the buyer is not

Q38: The revenue recognition principle indicates that revenue

Q39: The IASB

A)Has issued over 100 standards related

Q42: Use the following information for questions.The contract

Q43: Use the following information for questions.

In 2012,

Q44: Safe Skies Travel sells airplane tickets for

Q46: The following information relates to questions

Cooper

Q56: In consignment sales, the consignee

A) records the

Q73: A franchise agreement grants the franchisor an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents