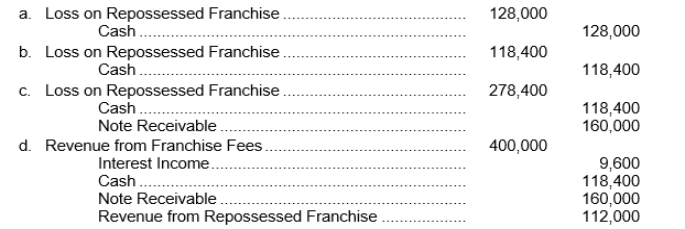

On April 1, 2012 Weston, Inc.entered into a franchise agreement with a local business-man.The franchisee paid $240,000 and gave a $160,000, 8%, 3-year note payable with interest due annually on March 31.Weston recorded the $400,000 initial franchise fee as revenue on April 1, 2012.On December 30, 2012, the franchisee decided not to open an outlet under Weston's name.Weston canceled the franchisee's note and refunded $128,000, less accrued interest on the note, of the $240,000 paid on April 1.What entry should Weston make on December 30, 2012?

Correct Answer:

Verified

Q73: Use the following information for questions.

Gorman Construction

Q74: Use the following information for questions.

Gomez, Inc.began

Q75: Spenders Company is an experienced home appliance

Q76: Use the following information for questions.

Eilert Construction

Q77: Spenders Company is an experienced home appliance

Q78: Use the following information for questions.

Kiner, Inc.began

Q79: Lark Corp.has a contract to construct a

Q80: Wynn, Inc.has a contract to construct a

Q81: On January 1, 2012 Dairy Treats, Inc.entered

Q83: On December 31, 2010, Gledhill, Inc.sells production

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents