Under IFRS,

A) The accounting for non-trading equity investments deviates from the general provisions for equity investments.

B) Realized gains and losses related to changes in the fair value of non-trading equity investments are reported as a part of other comprehensive income and as a component of other accumulated comprehensive income.

C) Dividends received in cash are always reported as income on the income statement.

D) All of the choices are correct.

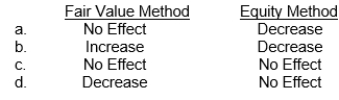

51.Santo Corporation declares and distributes a cash dividend that is a result of current earnings.How will the receipt of those dividends affect the investment account of the investor under each of the following accounting methods?

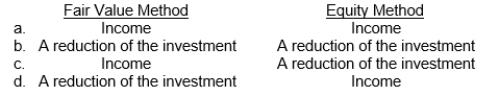

P<\sup>52.An investor has a long-term investment in ordinary shares.Regular cash dividends received by the investor are recorded as

Correct Answer:

Verified

Q22: In accounting for debt investments that are

Q30: Which of the following is not a

Q32: An unrealized holding gain or loss on

Q39: Amortized cost is the initial recognition amount

Q40: Which of the following are reported at

Q44: Under IFRS, the presumption is that equity

Q46: Under IFRS, a company

A)Should evaluate every investment

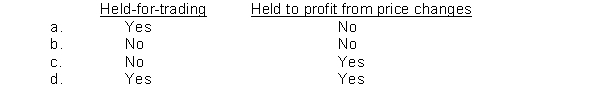

Q55: Companies that attempt to exploit inefficiencies in

Q57: Companies account for transfers of investments between

Q66: All of the following are characteristics of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents