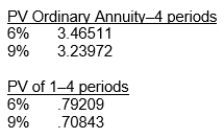

Mae Jong Corp.issues 1,000 convertible bonds at the beginning of 2011.The bonds have a four-year term with a stated rate of interest of 6 percent, and are issued at par with a face value of €1,000 per bond (the total proceeds received from issuance of the bonds are €1,000,000) .Interest is payable annually at December 31.Each bond is convertible into 250 ordinary shares with a par value of €1.The market rate of interest on similar non-convertible debt is 9 percent.Compute the liability component of Mae Jong's convertible dent.The following present value factors are available:

A) €1,000,000

B) €750,000

C) €902,813

D) €916,337

Correct Answer:

Verified

Q22: The conversion of bonds is most commonly

Q35: Mae Jong Corp issues $1,000,000 of 10%

Q37: Fogel Co.has $2,500,000 of 8% convertible bonds

Q38: For share appreciation rights, the measurement date

Q40: On July 1, 2012, an interest payment

Q41: Mae Jong Corp.issued 1,000 convertible bonds at

Q42: On January 1, 2011 Reese Company granted

Q44: Mae Jong Corp.issued 1,000 convertible bonds at

Q50: An executive pays no taxes at time

Q56: Pelton, Inc.issued £2,000,000 par value, 7% convertible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents