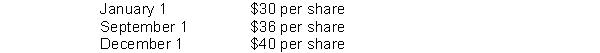

On January 1, 2012, Trent Company granted Dick Williams, an employee, an option to buy 100 shares of Trent Co.shares for $30 per share, the option exercisable for 5 years from date of grant.Using a fair value option pricing model, total compensation expense is determined to be $900.Williams exercised his option on September 1, 2012, and sold his 100 shares on December 1, 2012.Quoted market prices of Trent Co.shares during 2012 were:

The service period is for two years beginning January 1,2012.As a result of the option granted to Williams, using the fair value method, Trent should recognize compensation expense for 2012 on its books in the amount of

A) $1,000.

B) $900.

C) $450.

D) $0.

Correct Answer:

Verified

Q41: Mae Jong Corp.issued 1,000 convertible bonds at

Q42: On January 1, 2011 Reese Company granted

Q44: Mae Jong Corp.issued 1,000 convertible bonds at

Q45: Use the following information for questions.

On May

Q47: In 2011, Eklund, Inc., issued for $103

Q48: On April 7, 2012, Kegin Corporation sold

Q49: Use the following information for questions.

On May

Q50: Mae Jong Corp.issued 1,000 convertible bonds at

Q51: During 2012, Gordon Company issued at 104

Q56: Pelton, Inc.issued £2,000,000 par value, 7% convertible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents