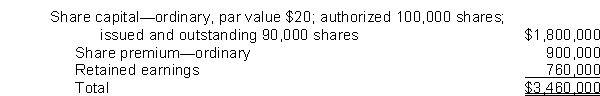

An analysis of equity of Hahn Corporation as of January 1, 2012, is as follows:

Hahn uses the cost method of accounting for treasury shares and during 2010 entered into the following transactions:

Acquired 2,500 of its shares for $75,000.

Sold 2,000 treasury shares at $35 per share.

Sold the remaining treasury shares at $20 per share.

Assuming no other equity transactions occurred during 2012, what should Hahn report at December 31, 2012, as total share premium?

A) $895,000

B) $900,000

C) $905,000

D) $915,000

Correct Answer:

Verified

Q64: Sosa Co.'s equity at January 1, 2012

Q65: Luther Inc., has 2,000 shares of 6%,

Q66: Hiro Corp.issues 1,000 €5 par value ordinary

Q67: Wheeler Company issued 5,000 shares of its

Q68: On September 1, 2012, Valdez Company reacquired

Q70: Manning Company issued 10,000 shares of its

Q71: On December 1, 2012, Abel Corporation exchanged

Q72: Glavine Company issues 6,000 shares of its

Q73: Long Co.issued 100,000 shares of $10 par

Q74: On January 1 Hiro Corp.issues 1,000 no-par

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents