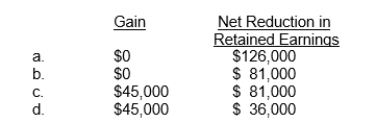

Pierson Corporation owned 10,000 shares of Hunter Corporation.These shares were purchased in 2009 for $90,000.On November 15, 2011, Pierson declared a property dividend of one share of Hunter for every ten shares of Pierson held by a shareholder.On that date, when the market price of Hunter was $14 per share, there were 90,000 shares of Pierson outstanding.What gain and net reduction in retained earnings would result from this property dividend?

Correct Answer:

Verified

Q89: Stinson Corporation owned 30,000 shares of Matile

Q90: Winger Corporation owned 900,000 shares of Fegan

Q91: Everwood Co.issues 10,000 shares of £10 par

Q92: Hernandez Company has 350,000 shares of $10

Q93: On January 1, 2012, Culver Corporation had

Q95: Colson Inc.declared a $160,000 cash dividend.It currently

Q96: Janae Corporation has outstanding 10,000 shares of

Q97: Gibbs Corporation owned 20,000 shares of Oliver

Q98: The equity of Howell Company at July

Q99: The equity section of Gunkel Corporation as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents