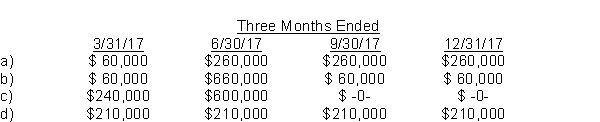

On January 15, 2017, Truro Corp.paid $240,000 in property taxes on its factory building for the calendar year 2017.In the first week of April 2017, the corporation made unanticipated repairs to its plant equipment at a cost of $600,000.These repairs will benefit operations for the remainder of 2017 only.How should these expenses be reflected in Truro's quarterly income statements?

Correct Answer:

Verified

Q9: Which of the following statements is INCORRECT

Q23: The following information pertains to Crabapple Corp.and

Q23: When an auditor expresses a qualified opinion

Q24: Accounting issues involved for unincorporated businesses include

A)

Q25: Peach Corp.has estimated that total depreciation expense

Q26: Which statement is INCORRECT regarding guidance given

Q27: An auditor's adverse opinion

A) although very rare

Q27: Prune Juice Corp.reported the following data on

Q33: Which of the following is NOT a

Q37: The ratios that reflect financial strength are

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents