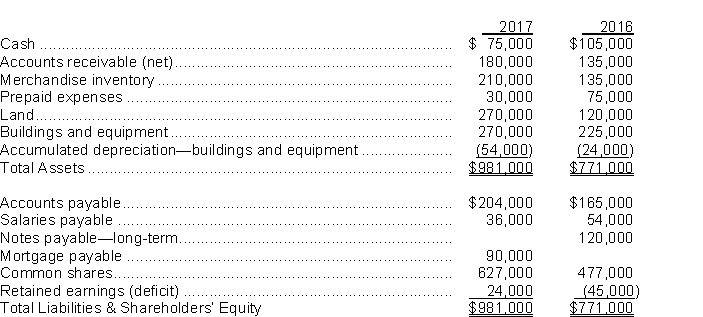

The statements of financial position for King Lear Corp.at the end of 2017 and 2016 are as follows:  During 2017, land was acquired in exchange for common shares (which had a market value of $150,000 at the time) .All equipment purchased was for cash.Equipment costing $15,000 was sold for $6,000 cash; book value of the equipment at the time of sale was $12,000, and the loss was included in net income.Cash dividends of $30,000 were declared and paid during the year.King adheres to ASPE and uses the indirect method when preparing the statement of cash flows.The cash provided by operating activities for calendar 2017 was

During 2017, land was acquired in exchange for common shares (which had a market value of $150,000 at the time) .All equipment purchased was for cash.Equipment costing $15,000 was sold for $6,000 cash; book value of the equipment at the time of sale was $12,000, and the loss was included in net income.Cash dividends of $30,000 were declared and paid during the year.King adheres to ASPE and uses the indirect method when preparing the statement of cash flows.The cash provided by operating activities for calendar 2017 was

A) $72,000.

B) $78,000.

C) $84,000.

D) $99,000.

Correct Answer:

Verified

Q38: Use the following information for questions.

Marcellus Corp.provided

Q39: Use the following information for questions.

Oswald Ltd.has

Q40: When preparing a statement of cash flows,

Q41: Use the following information for questions.

During calendar

Q42: Macbeth Corp.'s comparative statements of financial position

Q44: Edgar Inc.reported net income for calendar 2017

Q45: Use the following information for questions.

Financial statements

Q46: Use the following information for questions.

Financial statements

Q47: Use the following information for questions.

Financial statements

Q48: During calendar 2017, Marcellus Inc.sold equipment for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents