Use the following information for questions.

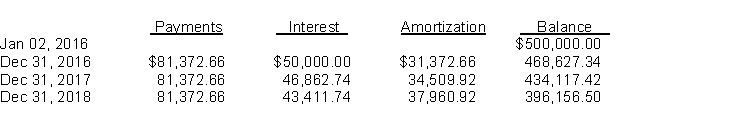

Ball Ltd.purchased land and constructed a service station, at a total cost of $450,000.On January 2, 2016, when construction was completed, Ball sold the service station and land to a major oil company for $500,000, and immediately leased it back from the oil company.Fair value of the land at the time of the sale was $50,000.The lease is a 10-year, non-cancellable lease.Ball uses straight-line amortization for its other assets.The economic life of the station is 15 years with zero residual value.Title to the property will revert back to Ball at the end of the lease.A partial amortization schedule for this lease follows:

-The total lease-related income recognized by the lessee during 2017 is

A) $0.

B) $3,333.

C) $5,000.

D) $50,000.

Correct Answer:

Verified

Q56: Frank Corporation has an asset with a

Q57: On July 1, 2017, Justin Ltd., a

Q58: On December 31, 2017, Eastern Inc.leased machinery

Q62: If a corporation adhering to IFRS sells

Q62: On May 1, 2017, Charles Corp.leased equipment

Q63: Under IFRS, if land is the sole

Q63: On December 31, 2017, Lewis Ltd.sold a

Q64: Sukwinder Corp.manufactures equipment for sale or lease.On

Q66: On May 1, 2017, Charles Corp.leased equipment

Q68: Use the following information for questions.

Ball Ltd.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents