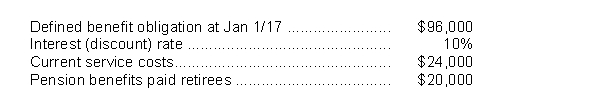

The following information pertains to Rembrandt Inc.'s pension plan for calendar 2017:  The corporation uses IFRS.If no change in actuarial estimates occurred during 2017, Rembrandt's defined benefit obligation at December 31, 2017 would be

The corporation uses IFRS.If no change in actuarial estimates occurred during 2017, Rembrandt's defined benefit obligation at December 31, 2017 would be

A) $85,600.

B) $100,000.

C) $105,600.

D) $109,600.

Correct Answer:

Verified

Q49: Presented below is pension information related to

Q50: Bateman Corp.provides a defined benefit pension plan

Q51: Presented below is pension information related to

Q53: Under IFRS for employee future benefits besides

Q55: Raphael Inc.provides a defined benefit plan for

Q56: Presented below is information related to Peach

Q62: How should employers recognize employee benefit plans

Q65: The major difference in accounting for pensions

Q69: Which of the following disclosures of post-employment

Q80: Under IFRS all of the following are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents