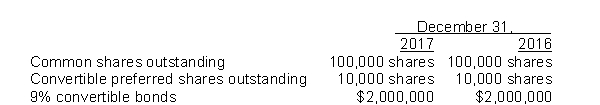

Information concerning the capital structure of Shelmardine Corporation follows  During 2017, Shelmardine paid dividends of $1.00 per common share and $2.50 per preferred share.The preferred shares are non-cumulative, and convertible into 20,000 common shares.The 9% convertible bonds are convertible into 50,000 common shares.Net income for calendar 2017 was $500,000.Assume the income tax rate is 30%.

During 2017, Shelmardine paid dividends of $1.00 per common share and $2.50 per preferred share.The preferred shares are non-cumulative, and convertible into 20,000 common shares.The 9% convertible bonds are convertible into 50,000 common shares.Net income for calendar 2017 was $500,000.Assume the income tax rate is 30%.

What is the diluted earnings per share for 2017?

A) $4.00

B) $3.68

C) $3.54

D) $2.94

Correct Answer:

Verified

Q40: At December 31, 2016, Tantalum Corp.had 300,000

Q41: At December 31, 2016, Jack Russell Ltd.had

Q42: At December 31, 2017, Spearmint Inc.had 300,000

Q44: On December 31, 2016, RojoLtd.had 2,000,000 common

Q45: At December 31, 2016, Skye Inc.had 500,000

Q46: On January 2, 2017, Helisinki Ltd.issued at

Q47: During 2017, Madrid Ltd.had 200,000 common shares,

Q48: Throughout 2017, Moon Ltd.had 1,200,000 common shares

Q50: At December 31, 2016, Labrador Ltd.had 800,000

Q51: Warrants exercisable at $ 20 each to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents