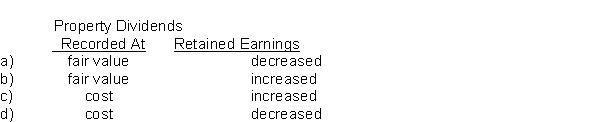

Emily Corp.owned shares in Carr Ltd.On December 1, 2017, Emily declared and distributed a property dividend of Carr shares when their fair value exceeded the carrying amount.As a consequence of the dividend declaration and distribution, the accounting effects would be

Correct Answer:

Verified

Q50: An investment in marketable securities was distributed

Q56: A corporation declared a dividend, a portion

Q57: The dollar amount of a cash dividend

Q57: On May 1, 2017, when the market

Q58: Which of the following is NOT a

Q81: Shareholders' equity is generally classified into two

Q86: Hamilton Ltd. has both common shares and

Q92: The price earnings (P/E) ratio is calculated

Q93: The payout ratio can be calculated by

A)

Q95: A "gain" on the sale of treasury

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents