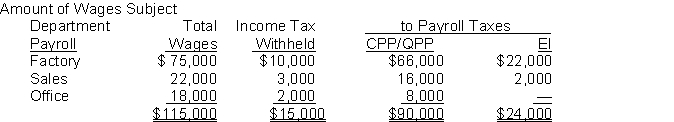

Willow Corp.'s payroll for the period ended October 31, 2017 is summarized as follows:  Assume the following payroll tax rates:

Assume the following payroll tax rates:

CPP/QPP for employer and employee 4.95% each

Employment Insurance 1.83% for employee

1.4 times employee premium for employer

To the nearest dollar, what amount should Willow accrue as its share of payroll taxes in its October 31, 2017 statement of financial position?

A) $ 4,894

B) $ 5,070

C) $ 6,102

D) $20,070

Correct Answer:

Verified

Q51: Ye Olde Shoppe operates in a province

Q52: Browning Company's salaried employees are paid biweekly.Information

Q53: The total payroll of Carbon Company for

Q54: Use the following information for questions.

Silver Ltd.has

Q55: Zircon Ltd., a GST registrant, buys $4,500

Q57: On September 1, 2017, Coffee Ltd.issued a

Q58: Use the following information for questions.

Antimony Inc.developed

Q59: On April 30, 2017, Canuck Oil Corp.purchased

Q60: At December 31, 2017, Manganese Corp.'s records

Q61: Woodwards Store sells major household appliance service

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents