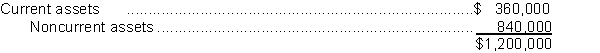

During 2017, Spokane Ltd.purchased the net assets of Tacoma Corp.for $635,000.On the date of the transaction, Tacoma reported $200,000 in liabilities.As well, the fair value of Tacoma's assets were:  How should the difference between the fair value of the net assets acquired and the cost be accounted for by Spokane?

How should the difference between the fair value of the net assets acquired and the cost be accounted for by Spokane?

A) The difference should be credited to retained earnings.

B) The difference should be recognized as a gain in net income.

C) The noncurrent assets should be reduced appropriately.

D) The difference should be prorated between the current and the noncurrent assets.

Correct Answer:

Verified

Q23: This year, Level Ground Ltd. went to

Q32: A patent is an example of a(n)

A)

Q33: Goodwill is the excess of purchase price

Q35: The cost of purchasing patent rights for

Q37: If a trademark is developed by the

Q40: A franchise or licence with a limited

Q41: Negative goodwill arises when

A) the book value

Q44: If the fair value of the net

Q47: Purchased goodwill should be

A) expensed as soon

Q55: All of the following are specifically identifiable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents