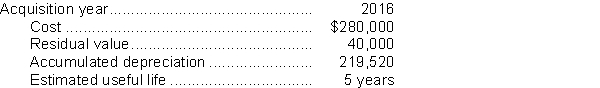

Swallow Ltd.takes a full year's depreciation expense in the year of an asset's acquisition and no depreciation expense in the year of disposition.Data relating to one of Swallow's pieces of equipment at December 31, 2018 are as follows:  Using the same depreciation method that was used in 2016, 2017, and 2018, how much depreciation expense should be recorded in 2019 for this asset?

Using the same depreciation method that was used in 2016, 2017, and 2018, how much depreciation expense should be recorded in 2019 for this asset?

A) $60,480

B) $48,000

C) $32,000

D) $20,480

Correct Answer:

Verified

Q40: Marmoset Corporation purchased factory equipment that was

Q41: In January, 2017, Camel Corporation purchased a

Q43: On July 1, 2014, Puppy Corp.purchased a

Q44: For a company that uses ASPE, the

Q44: On March 24, 2017, Lion Ltd.purchased a

Q45: On April 10, 2017, Tiger Corp.purchased machinery

Q46: On April 1, 2012, Bear Ltd.purchased equipment

Q47: Monkey Shines Ltd., a Canadian public corporation,

Q59: A general description of the depreciation methods

Q77: Under the capital cost allowance system, which

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents