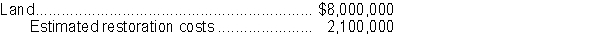

Roan Corp.acquired a tract of land containing an extractable natural resource.The company is required by the government to restore the land to a condition suitable for recreational use after it has extracted the natural resource.Geological surveys estimate that the recoverable reserves will be 6.2 million tons, and that the land will have a value of $1.2 million after restoration.Relevant cost information follows:  If Roan maintains no inventories, what is the depletion charge per ton of extracted resource?

If Roan maintains no inventories, what is the depletion charge per ton of extracted resource?

A) $1.00

B) $1.32

C) $1.44

D) $1.63

Correct Answer:

Verified

Q44: On March 24, 2017, Lion Ltd.purchased a

Q45: On April 10, 2017, Tiger Corp.purchased machinery

Q46: On April 1, 2012, Bear Ltd.purchased equipment

Q47: Monkey Shines Ltd., a Canadian public corporation,

Q48: On July 1, 2017, Eland Corp.purchased a

Q50: On September 25, 2017, Panther Corp.purchased machinery

Q51: On June 1, 2016 Morgan Manufacturing acquired

Q52: On January 3, 2010, Hippo Corp.purchased a

Q53: Consider an asset for which the following

Q54: On January 3, 2017, Coyote Corp.purchased machinery.The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents