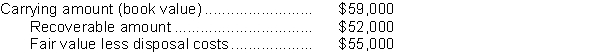

Gibbon Corp., a Canadian public corporation, owns equipment for which the following year-end information is available:  Which of the following best describes the proper accounting treatment for Gibbon's equipment?

Which of the following best describes the proper accounting treatment for Gibbon's equipment?

A) It is not impaired and a loss should not be recognized.

B) It is impaired and a loss must be recognized.

C) It is not impaired, but a loss must be recognized.

D) It is impaired and a loss must be recognized, but the loss but may be reversed in future periods.

Correct Answer:

Verified

Q52: On January 3, 2010, Hippo Corp.purchased a

Q53: Consider an asset for which the following

Q54: On January 3, 2017, Coyote Corp.purchased machinery.The

Q55: On April 1, 2015, Chickadee Corp.purchased new

Q56: On May 1, 2008, Platypus Ltd.purchased a

Q58: On January 2, 2017, Zebra Ltd.purchased equipment

Q59: In 2017, Elk Corporation purchased a mine

Q60: On July 1, 2017, Buffalo Corporation purchased

Q61: On January 1, 2017, the Accumulated Depreciation-Machinery

Q62: During 2017, Jersey Ltd.sold equipment that had

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents