Use the following information for questions.

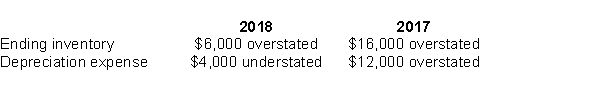

Shanti Inc.is a calendar-year corporation.Its financial statements for the years 2018 and 2017 contained errors as follows:

-Assume that no correcting entries were made at December 31, 2017.Ignoring income taxes, by how much will retained earnings at December 31, 2018 be overstated or understated?

A) $2,000 understated

B) $18,000 understated

C) $10,000 overstated

D) $18,000 overstated

Correct Answer:

Verified

Q84: For calendar 2017, the gross profit of

Q85: When the conventional retail inventory method is

Q86: Nottingham Inc.'s net sales and gross profit

Q87: To produce an inventory valuation which approximates

Q88: In its first year of operations as

Q90: Use the following information for questions.

Shanti Inc.is

Q91: Use the following information for questions.

Giselle Ltd.is

Q92: For calendar 2017, Redfern Corporation reported pre-tax

Q93: For calendar 2017, Gomez Corporation reported pre-tax

Q105: The average days to sell inventory ratio

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents