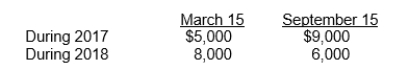

Mark-Wall Corp.'s trademark was licensed to Rodgers Inc.for royalties of 12% of sales of the trademarked items.Royalties are payable semi-annually on March 15 for sales in July through December of the previous year, and on September 15 for sales in January through June of the same year.Mark-Wall received the following royalties from Rodgers:  Rodgers estimates that sales of the trademarked items would total $67,000 for July through December 2018.On their statement of comprehensive income for calendar 2018, Mark-Wall's royalty revenue should be

Rodgers estimates that sales of the trademarked items would total $67,000 for July through December 2018.On their statement of comprehensive income for calendar 2018, Mark-Wall's royalty revenue should be

A) $8,040.

B) $14,000.

C) $14,040.

D) $21,000.

Correct Answer:

Verified

Q24: The main difference in the accounting for

Q58: Blue Corp.'s account balances at December 31,

Q59: On September 1, 2017, Black Corporation received

Q62: On September 1, 2017 Culver Corp.issued a

Q63: Frog Corporation had revenues of $300,000, expenses

Q64: On June 1, 2017, Carr Corp.loaned Farr

Q65: On December 1, 2017, Flynn Consulting paid

Q66: Barkley Company will receive $400,000 in a

Q67: Rathbone Corp.sells major household appliance service contracts

Q68: Grant Limited pays all salaried employees on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents