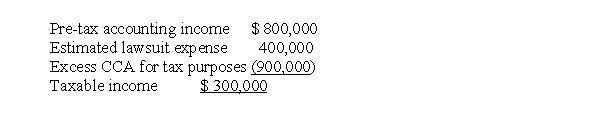

At the end of 2017, its first year of operations, Kali Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Kali adheres to IFRS requirements. The current income tax payable is

The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Kali adheres to IFRS requirements. The current income tax payable is

A) $ 0.

B) $ 75,000.

C) $150,000.

D) $200,000.

Correct Answer:

Verified

Q16: When calculating income tax expense, taxable income

Q18: Machinery was acquired at the beginning of

Q20: The tax base of a liability is

Q20: Of the various taxation options available to

Q22: The use of a Deferred Tax Asset

Q23: Macintyre Inc. sells household furniture on an

Q25: Casey Inc. uses the accrual method of

Q26: For calendar 2017, Melvin Corp. reported depreciation

Q40: A deferred tax liability is the

A) current

Q45: Recognition of tax benefits in a loss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents