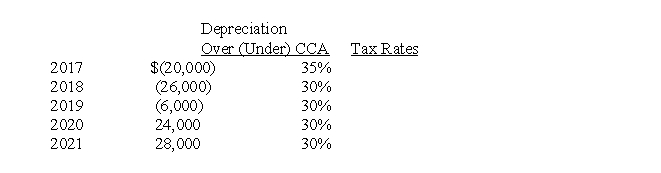

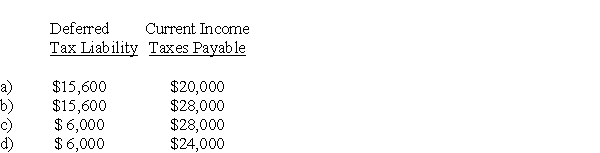

For calendar 2017, its first year of operations, Lion Ltd. reported pre-tax accounting income of $100,000. Lion uses CCA for tax purposes and straight-line depreciation for financial reporting. The differences between depreciation and CCA over the five-year life of their assets, and the enacted tax rates for 2017 to 2021 are as follows:  There are no other reversible differences. On Lion's December 31, 2017 statement of financial position, the deferred tax liability and the current income taxes payable should be

There are no other reversible differences. On Lion's December 31, 2017 statement of financial position, the deferred tax liability and the current income taxes payable should be

Correct Answer:

Verified

Q22: Taxable income of a corporation

A) differs from

Q30: Columbia Corp.'s partial income statement for its

Q31: On January 1, 2017, Wings Inc. purchased

Q32: Using IFRS, IAS 12 guidelines allow for

Q33: For calendar 2017, its first year of

Q36: Under IFRS, how are deferred tax asset

Q37: McMurray Inc. incurred an accounting and taxable

Q39: Shierling Corp. reported pre-tax accounting income of

Q41: Allocating income tax expense or benefit for

Q60: Recognizing a deferred tax asset for most

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents