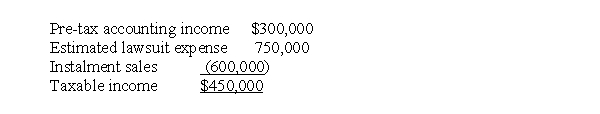

At the end of 2017, its first year of operations, Ontario Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The total income tax expense to be reported on the income statement is

The estimated lawsuit expense of $750,000 will be deductible in 2019 when it is expected to be paid. The instalment sales will be realized at $300,000 in each of the next two years. The income tax rate is 30% for all years. The total income tax expense to be reported on the income statement is

A) $90,000.

B) $135,000.

C) $150,000.

D) $300,000.

Correct Answer:

Verified

Q39: Shierling Corp. reported pre-tax accounting income of

Q40: Bare Fashions Corp. reported pre-tax accounting income

Q41: A reconciliation of Quebec Corp.'s pre-tax accounting

Q42: At the end of 2017, its first

Q44: Saucy Inc. reported a taxable and accounting

Q45: In 2017, Savoury Ltd. accrued, for book

Q46: Night Owl Inc. reports a taxable and

Q47: On January 2, 2016, Brunswick Corp. purchased

Q48: In its 2017 income statement, its first

Q60: Recognizing a deferred tax asset for most

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents