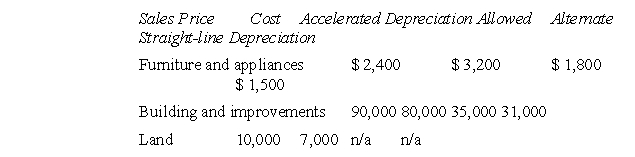

During the year, V sold an apartment purchased in 1980.Assume that V claimed all depreciation allowed.The sale is summarized as follows:  What is V's§ 1231 gain?

What is V's§ 1231 gain?

A) $44,000

B) $45,000

C) $48,000

D) $49,000

Correct Answer:

Verified

Q24: The additional depreciation recapture for a corporation

Q25: N purchased a camera for use in

Q26: Y suffered a theft of depreciable assets

Q27: C sold a house held for rental

Q28: X sold a rental house at a

Q30: Y sold a partially depreciated office building

Q31: Z sold an office building at a

Q32: R realized a gain of $10,000 on

Q33: Which one of the following is not

Q34: Which of the following is statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents