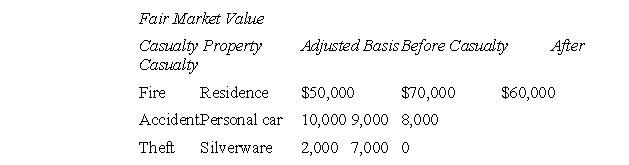

M had three separate casualties involving personal use property during the current year:  M received insurance reimbursement as follows: $8,000 for damages to home; $700 for repair of car; and $5,000 for theft of silverware.Which of the following is not necessarily true concerning M's gains and losses?

M received insurance reimbursement as follows: $8,000 for damages to home; $700 for repair of car; and $5,000 for theft of silverware.Which of the following is not necessarily true concerning M's gains and losses?

A) M must report each separate gain or loss as a gain or loss from the sale or exchange of a capital asset.

B) M's personal casualty gain exceeds her personal casualty losses by $900.

C) If M's personal casualty losses had exceeded her gain, then only so much of the net loss as exceeds 10 percent of A.G.I.could have been taken as an itemized deduction.

D) M's personal casualty gains and/or losses are long-term.

Correct Answer:

Verified

Q27: J purchased stock in X Corporation from

Q28: FGH, Inc.issued stock to individuals for $800,000

Q29: Which of the following netting processes does

Q30: When stock becomes worthless, the loss is

Q31: The purchase of an investment from a

Q33: The stock of a corporation involved in

Q34: Options to purchase property are always treated

Q35: Which of the following is not an

Q36: K sold the following investments during the

Q37: A taxpayer can defer gain on the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents