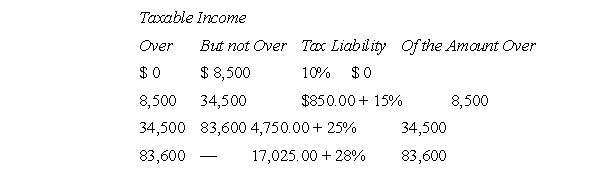

H is a single, calendar year, individual taxpayer.She has taxable income for the year 2011 of $70,000, including a net short-term capital gain of $5,000 and a net long-term (15 percent) capital gain of $30,000.The 2011 tax schedules for single taxpayers are as follows:  H's federal gross income tax for 2011 is

H's federal gross income tax for 2011 is

A) $14,000

B) $10,625

C) $18,125

D) $13,625

Correct Answer:

Verified

Q50: K had short-term capital losses of $2,000

Q51: G is a single, calendar year, individual

Q52: During the current year, J had long-term

Q53: D purchased an option to acquire 3

Q54: The de minimis amount of discount for

Q55: J and K, who file jointly, started

Q56: On July 1, 19X7, T, an investor,

Q58: Which of the following is not required

Q59: The importance of stock being designated §

Q60: Which one of the following is not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents