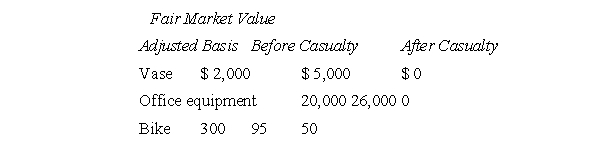

Last year F was accident-prone.He knocked over an expensive vase, shattering it; left an old radio on that caused a fire that destroyed his office equipment; and wrecked his bike.The bases and fair market values of the property are shown below.Assuming F does not elect to replace the vase or bike, and that he receives $5,000 for the vase, $25,000 for the office equipment, and $25 for the bike, what must he report?

A) $7,900 capital gain

B) $8,000 capital gain

C) $8,025 capital gain

D) $7,980 capital gain

E) Some other amount

Correct Answer:

Verified

Q27: W is an entrepreneur.He owns numerous companies

Q28: For tax purposes, LIFO inventories must be

Q29: R's personal sailboat is destroyed in a

Q30: For many years, T Corporation accounted for

Q31: F's furniture business suffered a substantial property

Q33: Taxpayers are not permitted to adopt LIFO

Q34: In the past, Zip Corporation has used

Q35: For financial accounting purposes, R uses FIFO

Q36: X, a psychiatrist, is a cash-basis taxpayer.He

Q37: The management of Mogul Manufacturing has decided

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents