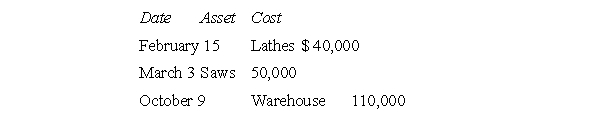

During the year, Fine Furnishings, a manufacturer of furniture, purchased the following assets:  In computing depreciation of these assets, which of the following conventions will be used?

In computing depreciation of these assets, which of the following conventions will be used?

A) Half-year, mid-month

B) Mid-quarter, mid-month

C) Half-year, mid-quarter, mid-month

D) Mid-quarter

E) Some combination other than those given above

Correct Answer:

Verified

Q17: Farmers may deduct expenditures for ponds and

Q18: Taxpayer N purchased numerous tax texts totaling

Q19: The entire cost of recovery property that

Q20: The facts-and-circumstances approach to determining the useful

Q21: Which property is depreciable using MACRS?

A)Manufacturing equipment

Q23: In 2012, B purchased a crane to

Q24: MACRS prescribes rates of depreciation determined by

Q25: Company G, a calendar year taxpayer, purchased

Q26: In November of this year, Creative Corn

Q27: During the year, T purchased the items

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents