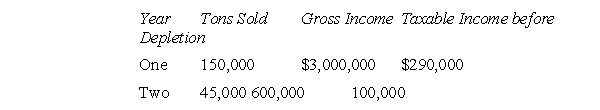

The Bloomingulch Company mines limestone.During the year the company purchased property south of town for $180,000.Engineers estimate that 200,000 tons of limestone are recoverable from the property.Given the following information, compute the company's depletion deduction for year two.Assume the depletion rate is 5 percent.

A) $30,000

B) $31,500

C) $40,500

D) $50,000

E) None of the above

Correct Answer:

Verified

Q37: Riverview Incorporated, a calendar year taxpayer, purchased

Q38: S purchased a used automobile to be

Q39: Which statement concerning class life and recovery

Q40: During the year, R purchased two items

Q41: Taxpayer K purchased a used stereo system

Q43: What conditions are necessary and sufficient to

Q44: The keeping of records required for listed

Q45: Last year, Taxpayer N purchased a car

Q46: Due to the ceiling on the amount

Q47: Ageless Oil Corporation is still eligible to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents