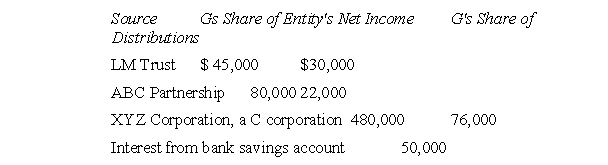

G is an 11-year-old heiress whose share of income from various sources is as follows for the current year:  G's A.G.I, (ignoring the deduction for one-half of any self-employment tax, if any) is how much?

G's A.G.I, (ignoring the deduction for one-half of any self-employment tax, if any) is how much?

A) $178,000

B) $605,000

C) $251,000

D) $236,000

Correct Answer:

Verified

Q29: The amount realized on the sale of

Q30: Brent, a 19-year-old student at Private University,

Q31: A taxpayer's motor home, which is used

Q32: H and W are married with twins,

Q33: A trust established for the benefit of

Q35: Assuming the selling price remains constant, the

Q36: Which one of the following is not

Q37: Short-term capital gains in excess of capital

Q38: T sold the family car at a

Q39: Sandy and Dave formed a law partnership,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents