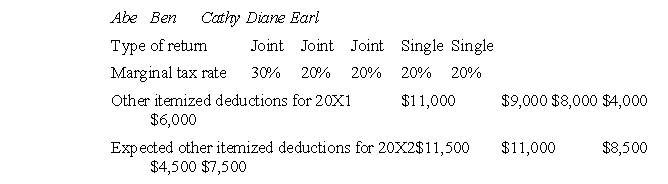

Each of the following individual taxpayers is planning on making a deductible $500 payment (e.g., a fully deductible charitable contribution) either in December 20X1 or in January 20X2.Assume the standard deduction for both years for joint filers is $10,000 and for single filers is $4,000.Ignore the time value of money.  Assuming that between years there are no changes in tax rates and other items (e.g., standard deduction, personal exemption, etc.) and ignoring the time value of money, who would gain the greatest tax savings by making the payment in 20X2 instead of 20X1?

Assuming that between years there are no changes in tax rates and other items (e.g., standard deduction, personal exemption, etc.) and ignoring the time value of money, who would gain the greatest tax savings by making the payment in 20X2 instead of 20X1?

A) Abe

B) Ben

C) Cathy

D) Diane

E) Earl

Correct Answer:

Verified

Q48: Which of the following is not a

Q49: Why are deductions of individual taxpayers broken

Q50: The following represent elements of the tax

Q51: The following represent elements of the tax

Q52: Which one of the following individuals likely

Q54: Last year, Ben and Jeri (unrelated) formed

Q55: Which of the following income is generally

Q56: Which one of the following taxes does

Q57: Barnum and Bailey incorporated their circus this

Q58: Which of the following is true of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents