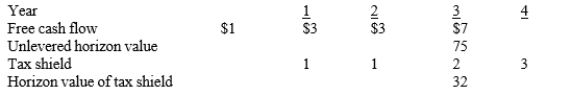

Brau Auto, a national autoparts chain, is considering purchasing a smaller chain, South Georgia Parts (SGP) . Brau's analysts project that the merger will result in the following incremental free cash flows, tax shields, and horizon values:  Assume that all cash flows occur at the end of the year. SGP is currently financed with 30% debt at a rate of 10%. The acquisition would be made immediately, and if it is undertaken, SGP would retain its current $15 million of debt and issue enough new debt to continue at the 30% target level. The interest rate would remain the same. SGP's pre-merger beta is 2.0, and its post-merger tax rate would be 34%. The risk-free rate is 8% and the market risk premium is 4%. What is the value of SGP to Brau?

Assume that all cash flows occur at the end of the year. SGP is currently financed with 30% debt at a rate of 10%. The acquisition would be made immediately, and if it is undertaken, SGP would retain its current $15 million of debt and issue enough new debt to continue at the 30% target level. The interest rate would remain the same. SGP's pre-merger beta is 2.0, and its post-merger tax rate would be 34%. The risk-free rate is 8% and the market risk premium is 4%. What is the value of SGP to Brau?

A) $53.40 million

B) $61.96 million

C) $64.64 million

D) $76.96 million

Correct Answer:

Verified

Q41: Great Subs Inc.,a regional sandwich chain,is considering

Q48: Kelly Tubes is considering a merger with

Q52: Firm X is considering acquiring Firm Y

Q53: Which of the following statements best describes

Q54: Which of the following statements best describes

Q54: Kelly Tubes is considering a merger with

Q55: Which of the following statements best describes

Q57: Firms A and B, both all-equity financed,

Q59: Which of the following statements best describes

Q61: What is the horizontal value of Maritime's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents