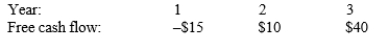

A company forecasts the free cash flows (in millions) shown below. The weighted average cost of capital is 13%, and the FCFs are expected to continue growing at a 5% rate after Year 3. Assuming that the ROIC is expected to remain constant in Year 3 and beyond, what is the Year 0 value of operations, in millions?

A)

B)

C)

D)

Correct Answer:

Verified

Q4: Simonyan Inc.forecasts a free cash flow of

Q8: If a company's expected return on invested

Q14: Akyol Corporation is undergoing a restructuring, and

Q15: Leak Inc. forecasts the free cash flows

Q16: The corporate valuation model cannot be used

Q18: Zhdanov Inc.forecasts that its free cash flow

Q19: Suppose Yon Sun Corporation's free cash flow

Q20: Which of the following statements is NOT

Q22: Vasudevan Inc. forecasts the free cash flows

Q25: Based on the corporate valuation model,Hunsader's value

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents