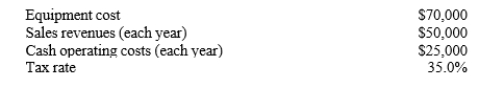

Your company, Q4 Inc., is considering a new project whose data are shown below. The required equipment has an economic year of 5 years, and has a CCA rate of 30% in class 10. Revenues and cash operating costs are expected to be constant over the project's 5-year operating life. What is the project's net operating cash flow during Year 2?

A) $16,213.00

B) $20,067.50

C) $22,497.50

D) $18,863.50

Correct Answer:

Verified

Q50: Langston Labs has an overall (composite) WACC

Q51: You work for the Sing Oil Company,

Q52: Q53: An increase in the risk-adjusted discount rate Q54: Which of the following is NOT a Q56: Which of the following rules is correct Q57: A company is considering a proposed new Q58: A firm is considering a new project Q59: You work for Athens Inc., and you Q60: Fool Proof Software is considering a new![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents