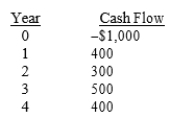

Van Auken Inc. is considering a project that has the following cash flows:  The company's WACC is 10%. What are the project's payback, IRR, and NPV?

The company's WACC is 10%. What are the project's payback, IRR, and NPV?

A) payback = 2.4, IRR = 10.00%, NPV = $600

B) payback = 2.4, IRR = 21.22%, NPV = $260

C) payback = 2.6, IRR = 21.22%, NPV = $300

D) payback = 2.6, IRR = 21.22%, NPV = $260

Correct Answer:

Verified

Q59: McCall Manufacturing has a WACC of 10%.The

Q63: Babcock Inc. is considering a project that

Q64: Frye Foods is considering a project that

Q65: Rappaport Enterprises is considering a project that

Q66: Which of the following statements is correct?

Q67: Adler Enterprises is considering a project that

Q69: Barry Company is considering a project that

Q71: Which of the following statements is correct?

Q73: Edmondson Electric Systems is considering a project

Q75: Projects A and B are mutually exclusive

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents