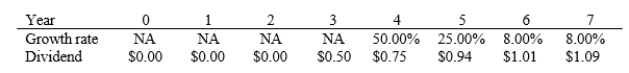

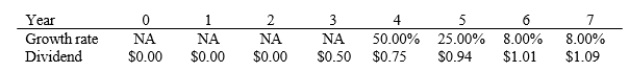

Beranek Technologies was founded 10 years ago. It has been profitable for the last 5 years, but it has needed all of its earnings to support growth and thus has never paid a dividend. Management has indicated that it plans to pay a $0.50 dividend 3 years from today, then to increase it at a relatively rapid rate for 2 years, and then to increase it at a constant rate of 8.00% thereafter. The forecast of the future dividend stream, along with the forecasted growth rates, is shown below. With a required return of 11.00%, what is the current intrinsic value?

A) $19.88

B) $20.39

C) $20.91

D) $21.44

Correct Answer:

Verified

Q48: The Isberg Company just paid a dividend

Q62: The Wei Company's last dividend was $1.75.

Q63: You must estimate the intrinsic value of

Q64: Sorenson Corp.'s expected year-end dividend is D1

Q65: The Nikko Company's last dividend was $1.50.

Q66: Goode Inc.'s stock has a required rate

Q70: Rentz RVs Inc. (RRV) is currently enjoying

Q71: Clinton's preferred stock pays a dividend of

Q72: Carter's preferred stock pays a dividend of

Q79: Schnusenberg Corporation just paid a dividend of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents