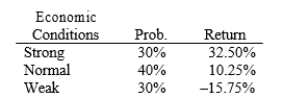

Your firm's analyst believes that economic conditions during the next year will be either strong, normal, or weak, and she thinks that Crary Inc.'s returns will have the probability distribution shown below. What's the standard deviation of Crary's returns as estimated by your analyst? (Hint: Use the formula for the standard deviation of a population, not a sample.)

A) 17.77%

B) 18.71%

C) 19.65%

D) 20.63%

Correct Answer:

Verified

Q107: Hocking Manufacturing Company has a beta of

Q108: ABC Co.has a beta of 1.30 and

Q109: Rick Kish has a $100,000 stock portfolio.Thirty-two

Q112: Rodriguez Roofing's stock has a beta of

Q115: Stock A has a beta of 1.2

Q116: Vera Paper's stock has a beta of

Q118: Yonan Corporation's stock had a required return

Q121: Ripken Iron Works believes the following probability

Q122: Returns for the Shields Company over the

Q134: A mutual fund manager has a $20

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents